If you’ve been dreaming of homeownership but struggling to afford a down payment, there’s great news—homebuyer assistance programs are growing at a record pace! The latest Q4 2024 Homeownership Program Index (HPI) Report from Down Payment Resource has revealed a 7% year-over-year increase, bringing the total number of assistance programs to 2,466.

This expansion means that both first-time and repeat buyers have more opportunities to access financial support. Whether you need down payment assistance (DPA), affordable loan options, or grants, the growing number of programs can make homeownership more achievable than ever before.

Table of Contents

More Down Payment Assistance Programs Than Ever

With rising home prices and high mortgage interest rates, many buyers find homeownership increasingly out of reach. However, down payment assistance (DPA) programs provide a vital solution. These programs help by reducing the upfront cash requirement, making it easier for buyers to qualify for a mortgage and secure financing.

How Down Payment Assistance Helps Homebuyers

The Q4 2024 HPI Report highlights a 6% reduction in the average loan-to-value (LTV) ratio for buyers using DPA programs. A lower LTV means lenders consider the loan less risky, improving a buyer’s chances of mortgage approval.

Other key highlights from the report include:

- 2,232 income-restricted programs (helping moderate-income buyers qualify)

- 234 programs with no income restrictions (19% increase from last year!)

This last statistic is a game-changer, as it means more middle-income homebuyers who previously exceeded income limits may now qualify for financial assistance.

Why This Matters in 2025

With inflation impacting purchasing power and mortgage rates still relatively high, having access to assistance programs could mean the difference between renting and homeownership. Buyers who take advantage of these programs can reduce their initial financial burden, allowing them to move into their new homes sooner.

First-Time Homebuyers Benefit the Most

If you’re a first-time homebuyer, 2025 is shaping up to be a fantastic year to buy. The number of first-time homebuyer programs has increased to 1,518, reflecting a 10% year-over-year growth.

Key Benefits for First-Time Buyers

These programs offer significant advantages, including:

- Lower down payment requirements (sometimes as low as 3%)

- Reduced mortgage interest rates

- Assistance with closing costs

- Grants and forgivable loans

Spotlight: City of San Antonio Homeownership Incentive Program

One standout program is the City of San Antonio Homeownership Incentive Program, which provides:

- Up to $15,000 in down payment assistance

- Available to first-time buyers earning between $74,350 and $140,200

- 75% of the loan forgiven over 10 years

This is just one example of the many first-time homebuyer programs making homeownership more accessible across the country.

Support for Multi-Family and Manufactured Homes

Many buyers are now looking beyond traditional single-family homes to multi-family properties and manufactured housing as more affordable alternatives.

Key Statistics on Expanding Support

According to the report:

- 805 programs now support multi-family home purchases (+17% YoY)

- 914 programs now support manufactured housing (+14% YoY)

Why This Matters

- Multi-family homes allow buyers to live in one unit and rent out the others, generating passive income to offset mortgage costs.

- Manufactured homes offer a lower-cost entry point into homeownership, making them a great option for affordability.

Spotlight: Affordable Housing Partnership Touhey Homeownership Foundation

This New York-based program offers:

- Up to $10,000 in grants for first-time Black homebuyers in Albany

- Up to $5,000 for purchases in surrounding cities

Spotlight: Champlain Housing Trust Down Payment Loan

In Vermont, the Champlain Housing Trust provides:

- Up to $40,000 in down payment loans for manufactured home buyers

- Loans structured as assumable second mortgages

These types of programs are helping expand alternative homeownership pathways for buyers who may not qualify for conventional home loans.

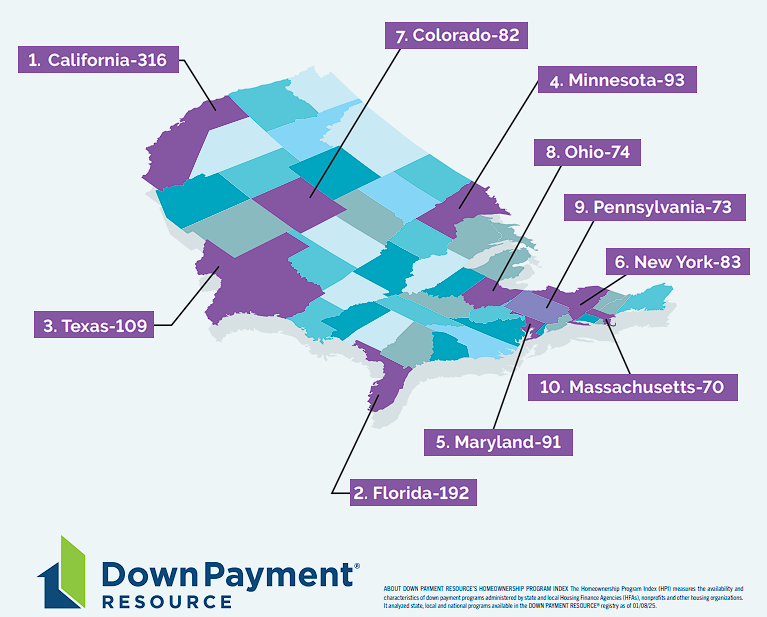

Growing Local and State Assistance Programs

One of the most exciting trends in 2025 is the expansion of local and state-level homebuyer assistance programs. More cities and municipalities are launching initiatives to help residents achieve homeownership, and existing programs are increasing their budgets and eligibility criteria.

Key Growth Trends in Local Assistance Programs

According to the Q4 2024 HPI Report:

- 171 local housing finance agencies (HFAs) now offer assistance programs – a 60% increase from 2023

- 968 municipalities offer down payment assistance programs, making homeownership more accessible in more cities than ever before

Types of Assistance Offered by Local Agencies

Local and state agencies provide several forms of financial aid, including:

- Grants – Free money that doesn’t require repayment

- Second mortgages – Low-interest or forgivable loans to help with down payments

- Below-market-rate (BMR) programs – Homes sold at reduced prices for eligible buyers

Spotlight: Atlanta Housing Homeownership Down Payment Assistance Program

A prime example of a growing local initiative is Atlanta’s Homeownership Down Payment Assistance Program, which provides:

- Up to $20,000 in assistance for eligible homebuyers

- Up to $25,000 for public safety, healthcare, and education professionals, military veterans, and disabled buyers

- A 10-year forgivable loan structure

With cities expanding their efforts to make housing more affordable, prospective buyers should check their local housing agencies for available assistance programs.

How to Apply for Down Payment Assistance Programs

Applying for down payment assistance might seem complex, but breaking it down into simple steps can make the process easier.

Step 1: Research and Determine Eligibility

Start by researching programs in your area. You can use tools like Down Payment Resource or check with your local housing finance agency (HFA). Key eligibility factors often include:

- Income limits (though many programs are expanding to moderate-income buyers)

- Credit score requirements

- Property Location and type

- First-time homebuyer status (though many programs accept repeat buyers)

Step 2: Apply for Assistance

Once you find a program that fits, submit an application. This usually involves:

- Connecting with a lender who works with the program

- Providing financial documents (pay stubs, tax returns, credit reports)

- Filling out application forms

Step 3: Attend a Homebuyer Education Course

Many assistance programs require applicants to complete a homebuyer education course, which:

- Can be completed online or in person

- Helps buyers understand mortgage terms, budgeting, and homeownership responsibilities

- Prepares first-time buyers for long-term financial stability

Step 4: Receive Approval and Assistance

If your application is approved, you will receive confirmation of:

- The amount of financial assistance granted

- Any repayment terms (if applicable)

- Program conditions (such as residency requirements)

Step 5: Purchase Your Home

Once approved, you can proceed with your home purchase. Some programs require that you already have a property under contract before final approval, so work closely with your real estate agent and lender to align your timeline.

Step 6: Comply with Program Requirements

Most down payment assistance programs have rules that must be followed, including:

- Occupancy requirements – The home must be your primary residence for a certain number of years

- Resale restrictions – Some programs prevent buyers from flipping the home for profit

- Income verification – Periodic income checks may be required for continued assistance

By following these steps, buyers can maximize their chances of approval and secure the financial help needed to achieve homeownership.

Key Takeaways for Homebuyers

The landscape of homebuyer assistance programs is expanding rapidly, offering more opportunities than ever for aspiring homeowners. Here are the most important points to remember:

- More homebuyer assistance programs exist than ever before – 2,466 programs are now available, a 7% YoY increase.

- First-time homebuyers have an advantage – 1,518 programs cater specifically to first-time buyers.

- Down payment assistance can lower borrowing costs – Many programs reduce the loan-to-value (LTV) ratio, improving mortgage approval chances.

- Multi-family and manufactured home support is increasing – More buyers can now invest in multi-unit properties or purchase manufactured homes with financial assistance.

- Local and state programs are growing fast – More cities and municipalities are offering grants and forgivable loans to encourage homeownership.

- Income restrictions are easing – Many new programs allow moderate-income buyers to qualify.

With more financial resources available, 2025 could be the perfect year to buy a home and take advantage of assistance programs.

Next Steps: Find Your Homebuyer Assistance Program

If you’re planning to buy a home in 2025, don’t assume that financial barriers will hold you back. Instead, explore local, state, and national programs that might provide the financial boost you need.

How to Start Your Search

- Check online resources – Use tools like Down Payment Resource to identify available programs specifically for your address, zip code, city, county, or state.

- Consult a mortgage lender – Many lenders have experience with down payment assistance programs and can guide you through the process.

- Speak with a real estate agent – A knowledgeable agent can help you find properties that qualify for assistance programs.

- Attend homebuyer workshops – Many local organizations offer free events to educate buyers about financial aid options.

With so many assistance programs expanding, this could be your year to achieve homeownership. Take the first step today and explore your options!

Are you ready to start your homeownership journey? Let’s connect and find the best program for you!

Final Thoughts

The homebuyer assistance landscape in 2025 is more promising than ever. With thousands of programs expanding across the country, first-time buyers, repeat buyers, and those considering alternative housing options all have more opportunities to secure financial support.

If you’ve been putting off buying a home due to financial concerns, now is the time to take action. Start researching, consult experts, and see if you qualify for assistance—your dream home could be closer than you think!

FAQs About Homebuyer Assistance Programs

1. Who qualifies for down payment assistance programs?

Most programs have income and credit score requirements, but many are now expanding to moderate-income buyers. Some programs are also available to repeat buyers, multi-family investors, and manufactured home buyers.

2. Do down payment assistance programs require repayment?

It depends on the program. Grants do not require repayment, while second mortgages and low-interest loans may have repayment terms. Some loans are forgivable over time, meaning you don’t have to repay them if you stay in the home for a set number of years.

3. Can I combine multiple homebuyer assistance programs?

Yes! Many buyers stack multiple programs, combining state, local, and national assistance options for additional financial support.

4. How long does it take to get approved for down payment assistance?

The timeline varies, but most programs take a few weeks to a few months for approval. To speed up the process, make sure you have all the required documents ready when applying.

5. Are there homebuyer assistance programs for high-income earners?

Yes! While most programs have income limits, over 230 programs have no income restrictions. These options are great for buyers who earn above typical limits but still need financial support.